Wise : Fast, convenient, low-cost payments to more than 70 countries in more than 50 currencies. OFX offers various money management tools, including risk management. OFX : Send money to more than 150 countries in more than 50 currencies. The best international money transfer app for you will depend on your needs, you can compare providers and choose the best one for yourself. International money transfer apps like OFX, Wise, and WorldRemit are often faster and cheaper than banks and traditional transfer providers. There are many alternatives to traditional banks and money transfer services. Go to Wise Go to OFX Best international money transfer apps

We’ll explore their pros and cons, and when they can be a good option. In this article, we will look at 6 methods that offer safe, cheap, and fast ways to pay international invoices. Best bank to transfer money internationallyĦ Cheap and Safe Ways to Pay International Invoicesĭo you have to pay overseas invoices? Paying international invoices for things like school fees, medical expenses, or utility bills can be difficult, time-consuming, and expensive.Best foreign currency accounts in the USA.Complete international wire transfer guide.You can also schedule automatic reminders warning customers when an invoice is overdue. To save time, set up automatic reminders for all new invoices in your Invoicing settings. Your customer will receive an email reminding them to pay the invoice. You can personalize the reminder before sending it. On a mobile phone, you can send reminders from an unpaid invoice’s details page. On a desktop computer, click the three-dot icon and click Remind. To send a reminder about an unpaid invoice, find it in your list of invoices. If needed, you can reshare a link to the unpaid invoice with your customer.Ĭan I send reminder emails for unpaid invoices? If your customer has a PayPal account, they can pay the invoice by logging into their account where they’ll see the invoice in their Activity. If your customer can’t find their email notification for an invoice, their email filter might have sent it to the junk folder. What if customers can’t find my invoices?

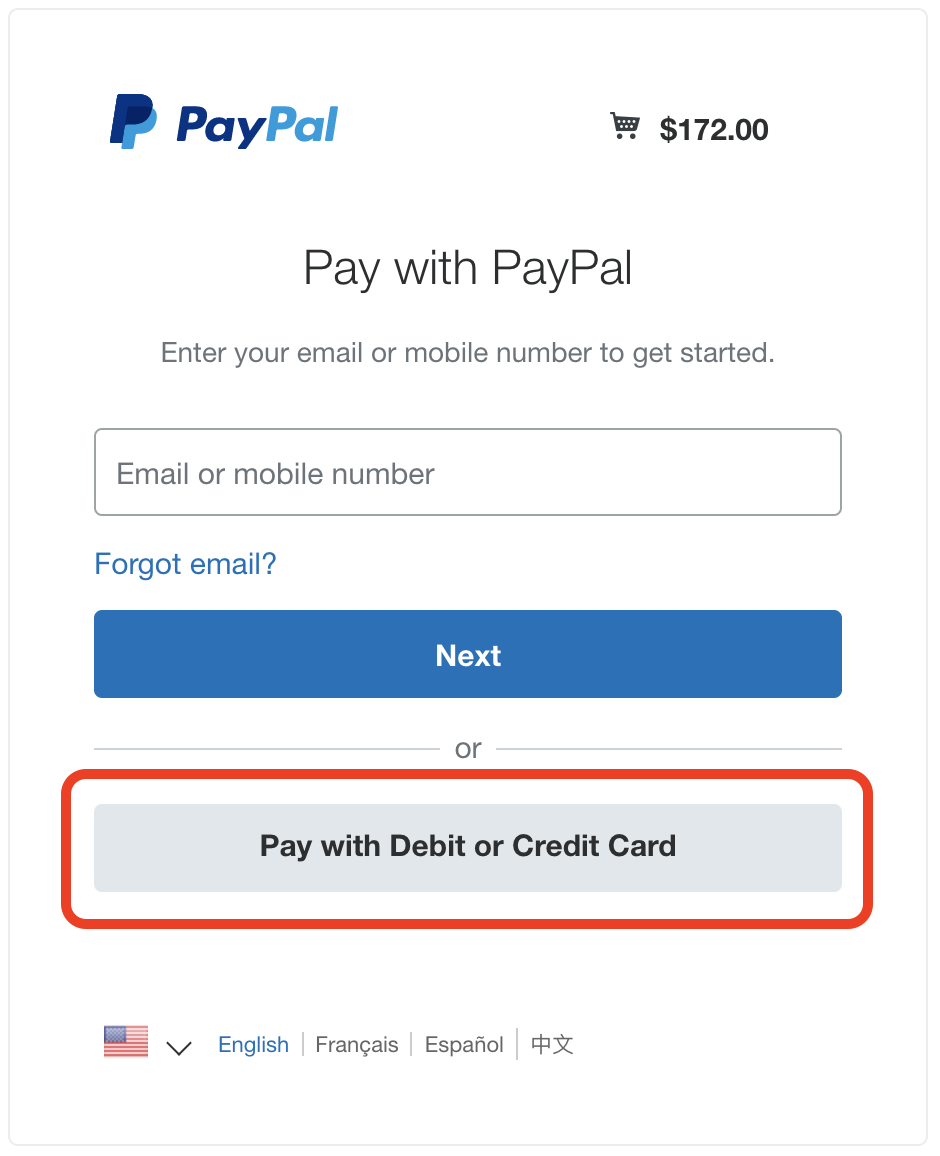

We may contact businesses if we suspect they’re not using this feature correctly. Partial payments aren’t a credit product or a way to allow for an excessive number of payments. A record of payments will appear on the invoice details. Your invoice will have a Partially Paid status until it’s fully paid. If you require a minimum amount due, your customer will need to pay at least that amount in their partial payment. This lets your customers make multiple payments toward the total amount of a single invoice. To accept partial payment from your customer, check the Allow partial payment box under payment options when you’re creating an invoice. They can pay you with their PayPal account, Venmo, Pay Later, and credit or debit card. In most countries, they don’t need a PayPal account to pay. PayPal customers can easily pay your invoices. When a customer pays you online, you’re charged a fee based on the amount of the purchase. PayPal Invoicing has no set up or monthly fees.

0 kommentar(er)

0 kommentar(er)